Stocks, Tweets, and Volatility

INFO 2950

5/5/23

Topic and Motivation

Our topic focuses the affect of tweets on stock volatility and changes in stock prices.

We are interested in trying to view if the volatility is affected by tweets about that particular stock and build a prediction of volatility based on this

We are also trying to investigate if the stock price is affected by the attitude of tweets toward a particular company. In other words, are these two variables independent

We were motivated to research this relationship because we were all curious about the short squeeze of particular “meme” stocks in January of 2021, and wanted to see the extent to which social media discussions affect stock price

Our Data

# A tibble: 20 × 13

tweet stock date last_price x1_day_return x2_day_return x3_day_return

<chr> <chr> <chr> <dbl> <dbl> <dbl> <dbl>

1 "@FAME95FM1… PayP… 31/0… 39.8 0.00201 0.0123 0.0123

2 "@CBSi Jama… PayP… 31/0… 39.8 0.00201 0.0123 0.0123

3 "@Hitz92fm … PayP… 31/0… 39.8 0.00201 0.0123 0.0123

4 "RT @nikita… Star… 31/0… 55.2 0.0123 0.0163 0.0163

5 "@gawker Ja… PayP… 31/0… 39.8 0.00201 0.0123 0.0123

6 "RT @cultco… Star… 31/0… 55.2 0.0123 0.0163 0.0163

7 "@amazon ha… Amaz… 31/0… 823. 0.00838 0.0149 0.0149

8 "RT @nia4_t… Star… 31/0… 55.2 0.0123 0.0163 0.0163

9 "Hmmm inter… Disn… 31/0… 111. 0.00262 -0.0122 -0.0122

10 "RT @IndiaH… Goog… 31/0… 820. 0.00444 0.0303 0.0303

11 "RT @Google… Goog… 31/0… 820. 0.00444 0.0303 0.0303

12 "@Dal_Schnu… Reut… 31/0… 49.4 -0.00268 0.00312 0.00312

13 "@natgeosoc… PayP… 31/0… 39.8 0.00201 0.0123 0.0123

14 "RT @IBMWat… Apple 31/0… 121. 0.00231 0.00494 0.00494

15 "Canadian @… eBay 31/0… 31.8 0.0107 0.0214 0.0214

16 "RT @KottiP… Reut… 31/0… 49.4 -0.00268 0.00312 0.00312

17 "RT @ColMor… Ford 31/0… 12.4 0.000809 0.0105 0.0105

18 "@HSBC is f… HSBC 31/0… 676. 0.00532 0.0166 0.0166

19 "Check out … eBay 31/0… 31.8 0.0107 0.0214 0.0214

20 "RT @nikita… Star… 31/0… 55.2 0.0123 0.0163 0.0163

# ℹ 6 more variables: x7_day_return <dbl>, px_volume <dbl>,

# volatility_10d <dbl>, volatility_30d <dbl>, lstm_polarity <dbl>,

# textblob_polarity <dbl>Tweet Sentiment’s Impact on Stock Returns by The Devastator on Kaggle.com

Over 850,000 data points

Variables of Interest:

- stock - A listed company’s name

- volatility_10d - The volatility of a company over a 10 day period

- tweet - A specific tweet directed toward the company

- lstm_polarity - The sentiment (postive/negative attitude) of a tweet toward a company

Highlights from EDA

Topics that interested us based on the data and our initial exploration:

How does the number of tweets in a given day affect the volatility of a stock

How does this hold across various market caps?

Is this different between generic stocks in our dataset and Apple, the current largest stock in the world

Does the attitude of a tweet toward a stock truly effect the price of the stock?

Cleaned the dataset by fixing column alignment and shifting rows.

Created an initial visualization using one stock to better understand relationships

Visualization of Number of Tweets’ Effect on Volatility

Our first inference model was to find the number of tweets and their affect on the volatility on a selection of stocks across market caps.

The first visualization below is specific to Facebook, Apple and Amazon. Companies apart of FAANG and generally in the upper echelon of market caps

Continued

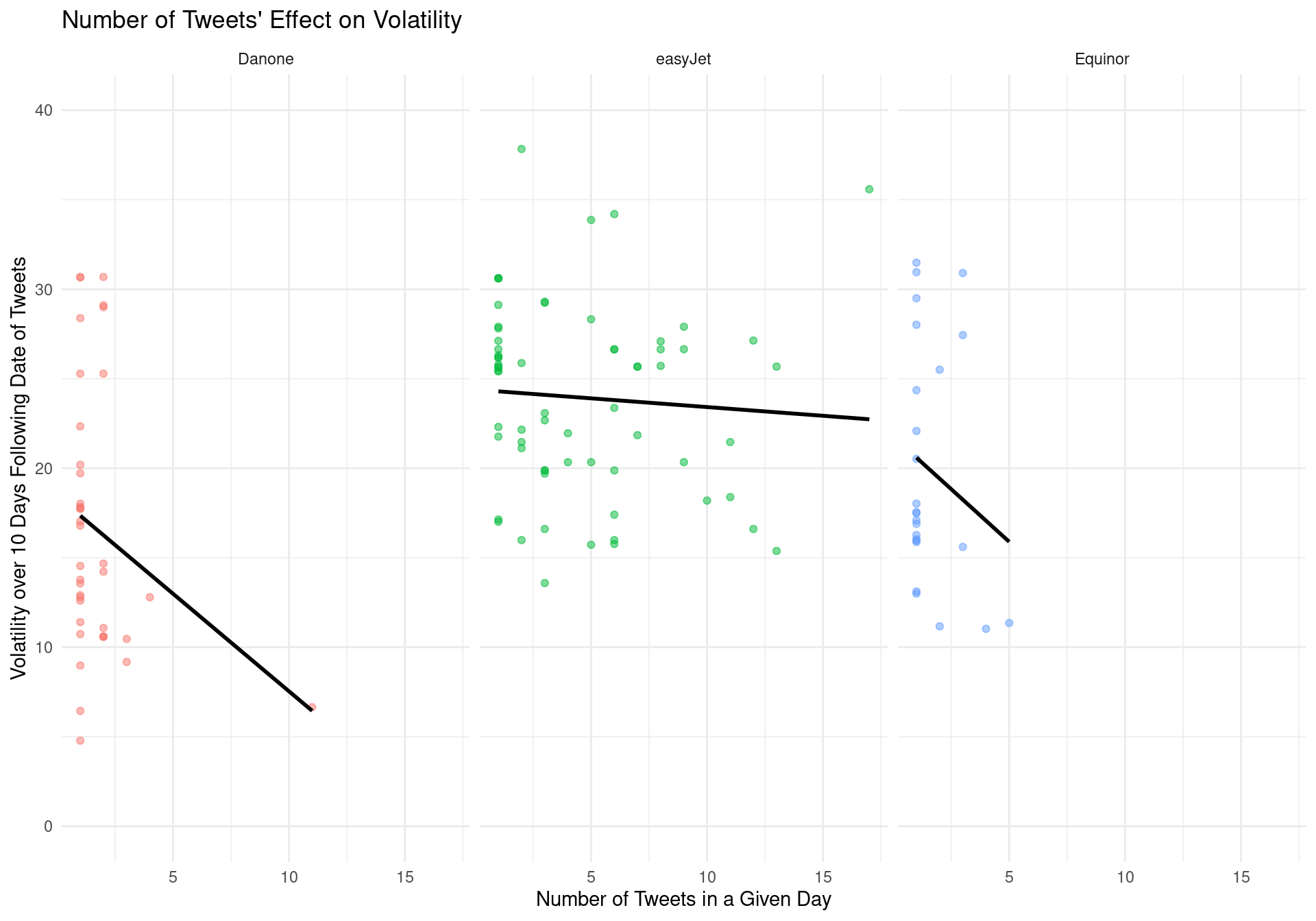

The second visualization below is specific to easyJet, Danone and Equinor. Companies with significantly smaller market caps then the previously mentioned companies.

Number of Tweets’ Effect on General Stock Volatility

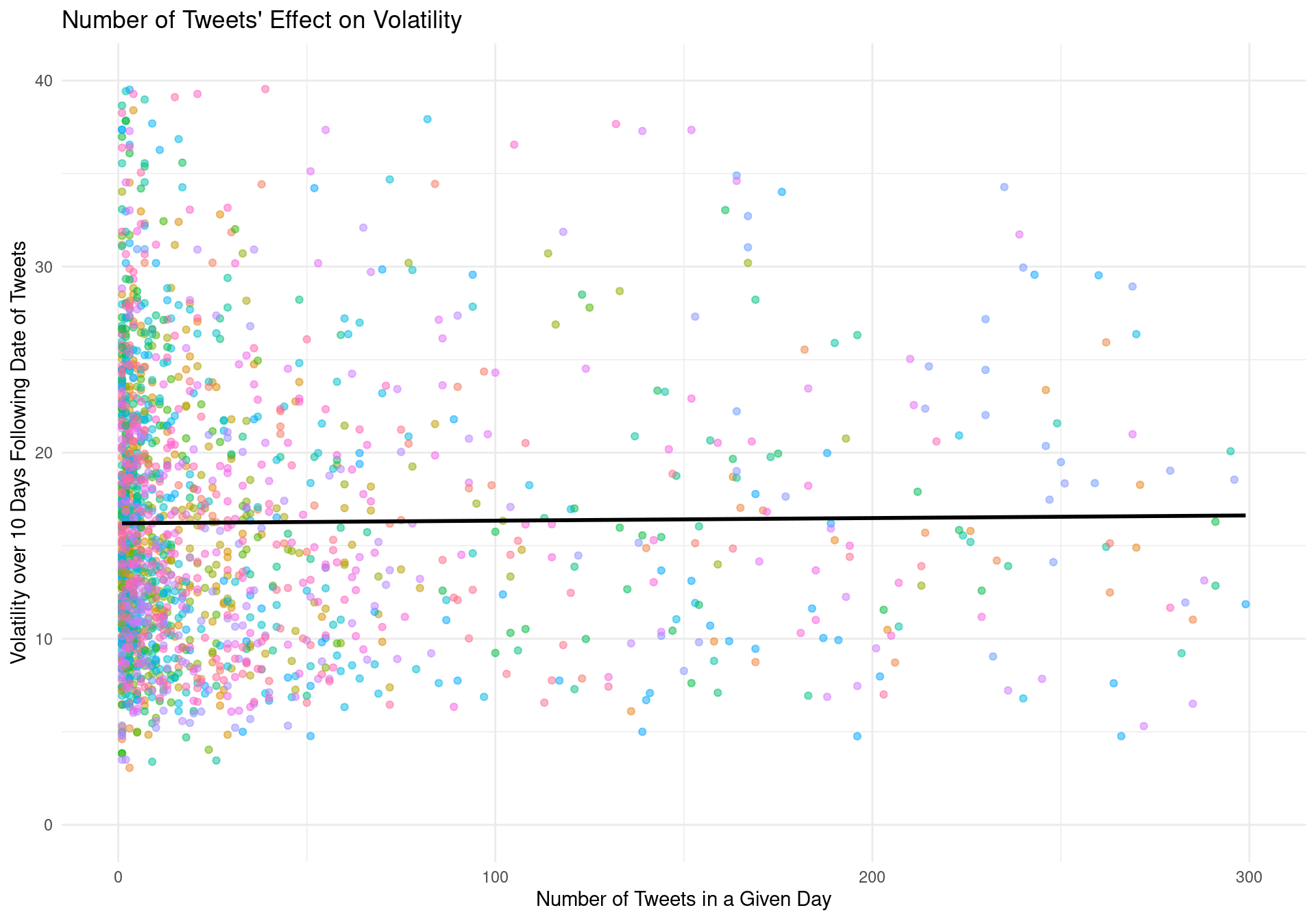

After seeing these relationships, we generalized the analysis to all stocks in the dataset.

- We specifically analyzed stocks from 2017 due to sheer dataset size.

Number of Tweets’ Effect on General Stock Volatility

\[ volatility = 18.35 + 0.00002 \times number~of~tweets \]

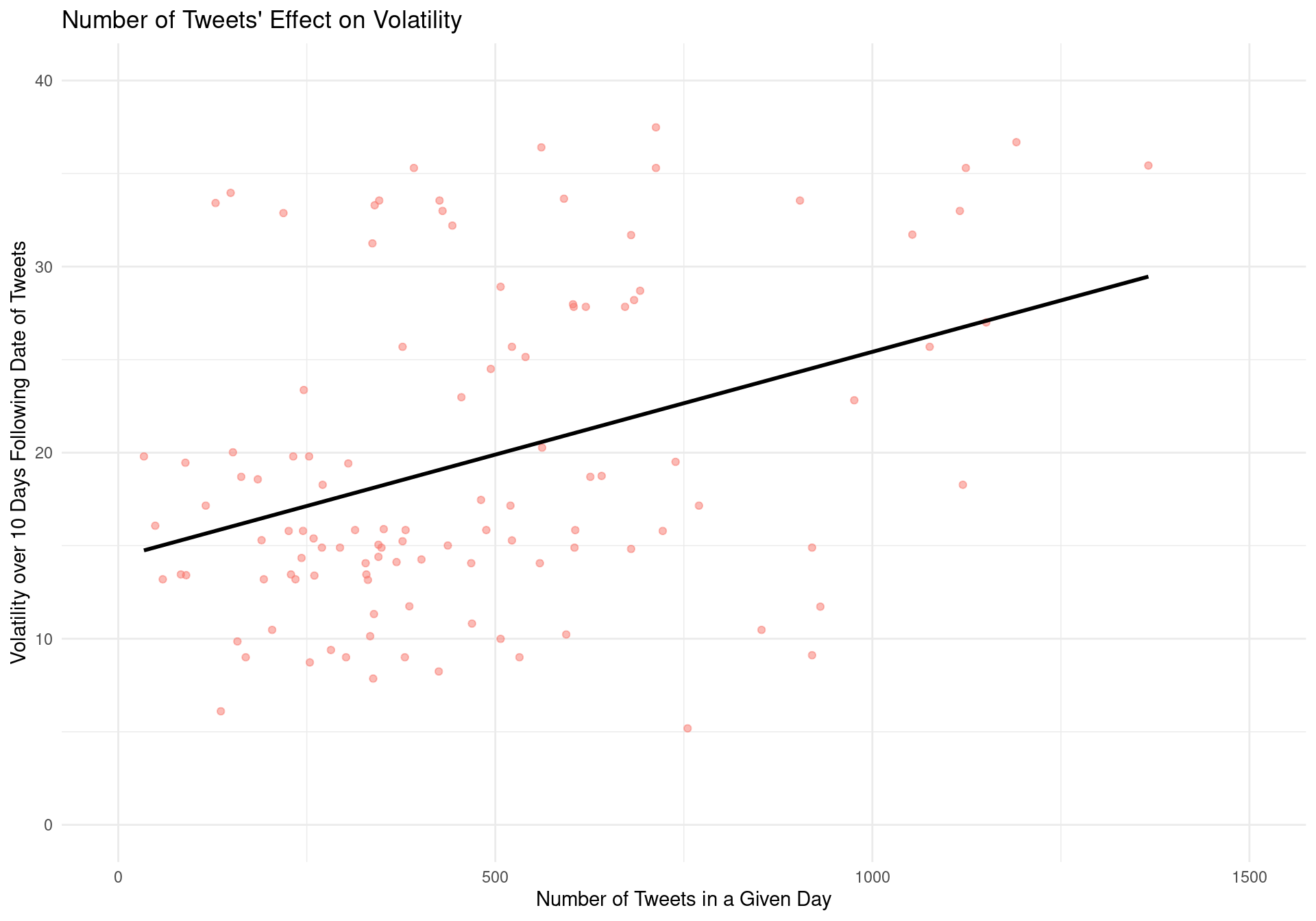

Number of Tweets’ Effect on Apple’s Volatility

Stocks are quite varied in many regards. We wanted to see if the same trends exist in the largest company in the world, Apple.

$7.3b ~ Average market cap of a US Stock in 2017

$860.88 b ~ Market cap of Apple in 2017 (end of year)

2.62 trillion ~ Market cap of Apple as of yesterday (5/5/2023)

Clearly, every stock is not the same!

Number of Tweets’ Effect on Apple’s Volatility

# A tibble: 2 × 5

term estimate std.error statistic p.value

<chr> <dbl> <dbl> <dbl> <dbl>

1 (Intercept) 17.5 1.30 13.5 9.62e-26

2 tweet_num 0.00607 0.00189 3.21 1.68e- 3\[ volatility = 17.78 + 0.00568 \times number~of~tweets \]

Tweet Sentiment’s Impact on Stock Price

Next, we analyzed the impact of attitude expressed in tweets on stock price

Question: Is the stock price impacted by the attitude of tweets for generic stocks? Are these independent?

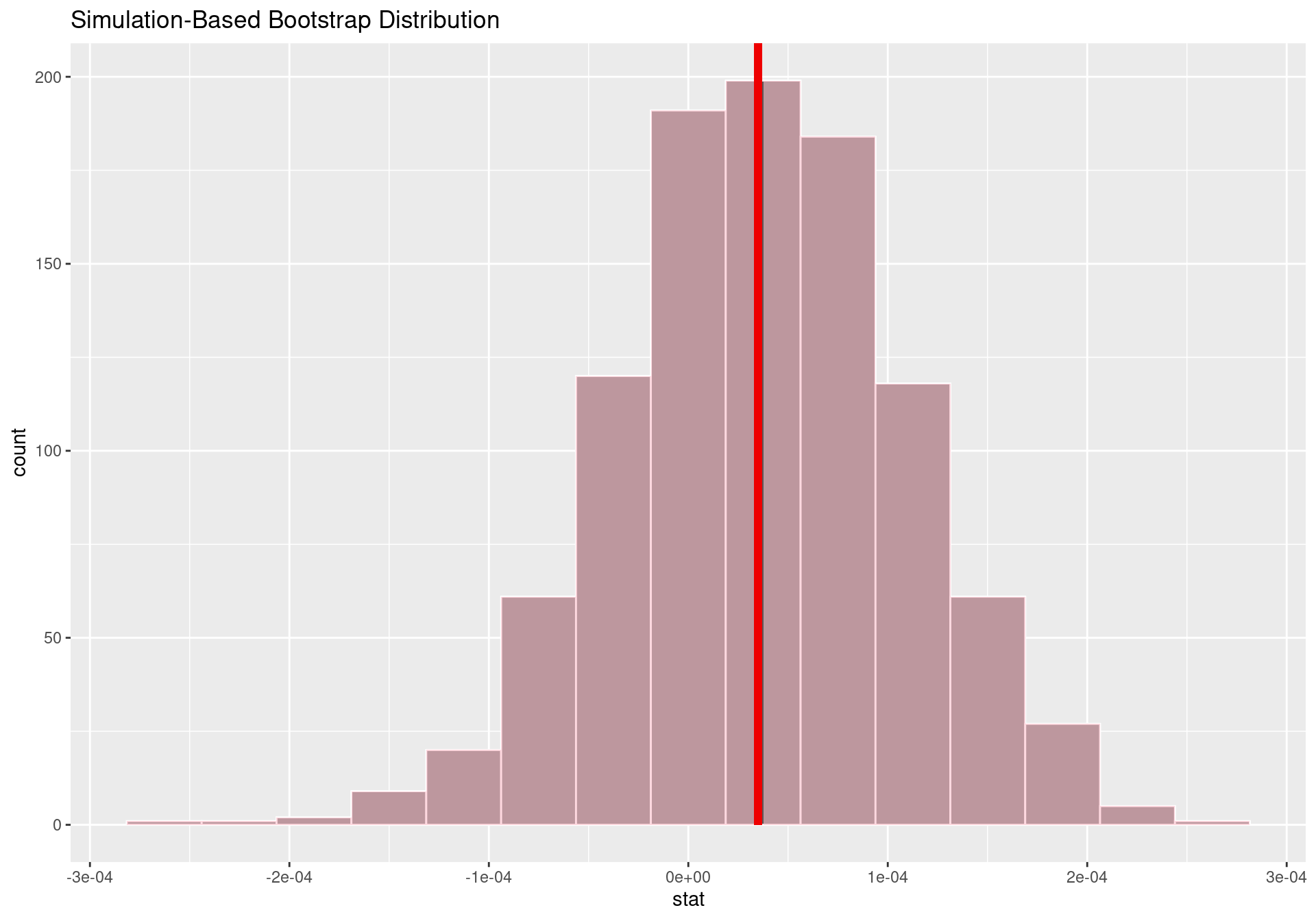

two-sided hypothesis test

- Null Hypothesis: There is no difference of 1 day changes in a stock’s price based on tweets attitude toward them

\[ H_0: \mu_1 - \mu_2 = 0 \]

- Alternate Hypothesis: There exists a difference of 1 day changes in a stock’s price based on tweets attitude toward them

\[ H_a: \mu_1 - \mu_2 \neq 0 \]

Tweet Sentiment’s Impact on Stock Price

# A tibble: 1 × 1

p_value

<dbl>

1 0.986

With a P-value is .986, we fail to reject the null hypothesis. The null hypothesis remains true

Our findings indicate that there is no difference of 1 day changes in stock prices for stocks based on tweets mentioning them

Conclusions + future work

Not much evidence to suggest tweet volume or sentiment affects stocks.

- Perhaps, this affect is difference across certain stocks? We saw that varying market caps seemed to imply an effect although not definite

The data set included a wide variety of stocks

- Possibility of dividing those stocks based on specific factors (market cap, volume, etc.) and re-analyzing based on these specific factors

- Rather then rely on the given LSTM-polarity scores, we re-analyze the tweets and expand text analysis and sentiment to further understand the impact of certain tweets.