Investigating Shark Tank Deals

Team Impressive Pikachu - INFO 2950

Jonathan Grossman

Sammy Relles

Davis Roberts

Claire Yun

5/5/23

Introduce the topic and motivation

In this study, we want to explore what makes a Shark Tank pitch more likely to reach a deal on the show. Specifically, how does the value of the business, their valuation, and their industry affect the likelihood of reaching a deal?

This question gives insight into how a pitch on Shark Tank may or may not ultimately get a deal. The information and its conclusions will be useful in that it may reveal that certain industries, investors, or investment deals prove to have higher success rates. This, in turn, could serve as a guide to future entrepreneurs looking to pitch their business on the show.

Introduce the data

We use the Shark Tank US data set created by Satya Thirumani. The dataset contains 1,038 observations and 52 attributes related to the pitches made by entrepreneurs to the Sharks in seasons 1 through 14 of the show.

The data was collected based on information that was disclosed during the pitch, as well as background information on the entrepreneur and their brand.

The purpose of the dataset is to identify any trends among investors, entrepreneurs, and the deals that are made between them. Each observation contains 52 columns regarding the business pitch.

Highlights from EDA

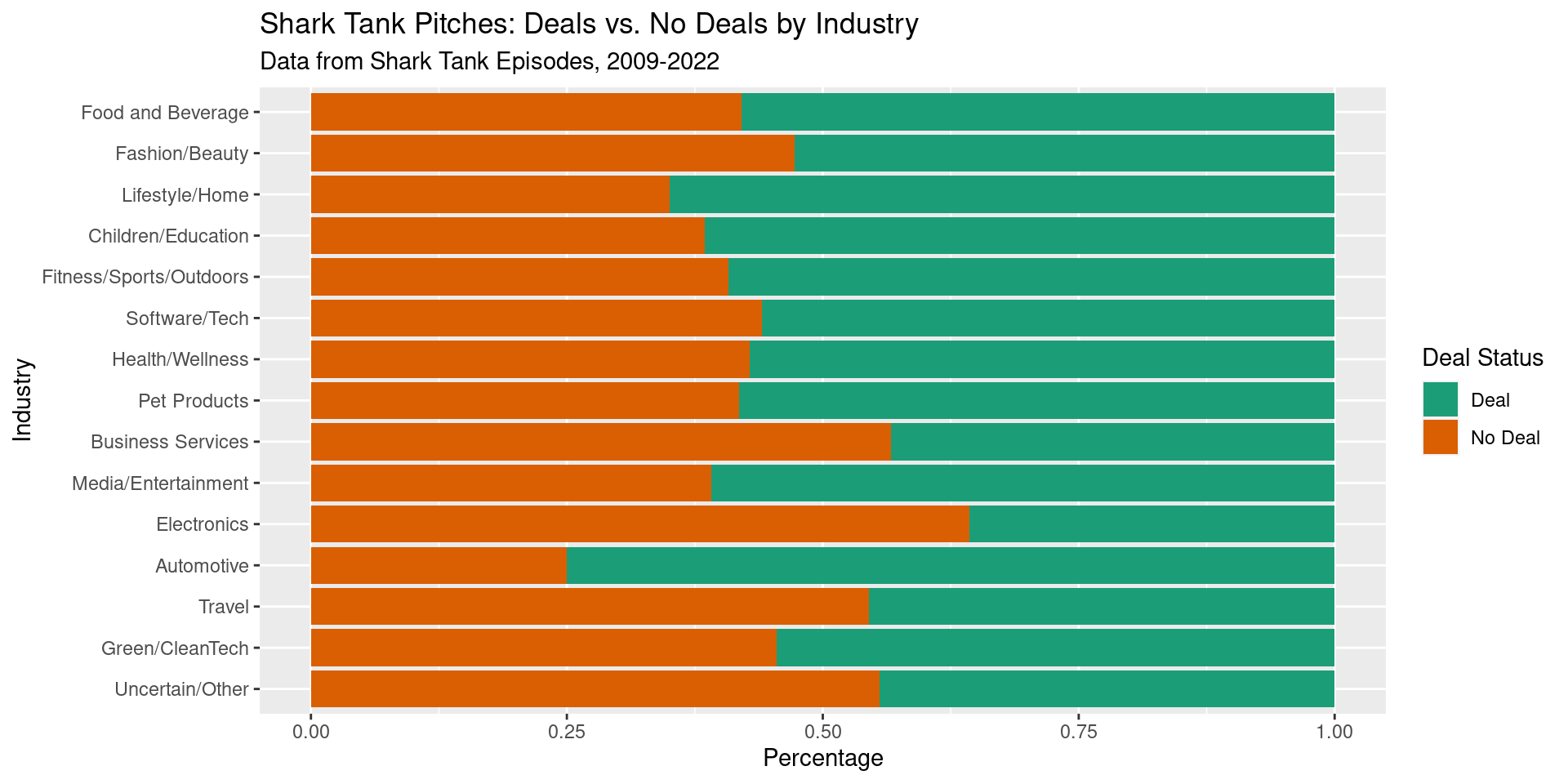

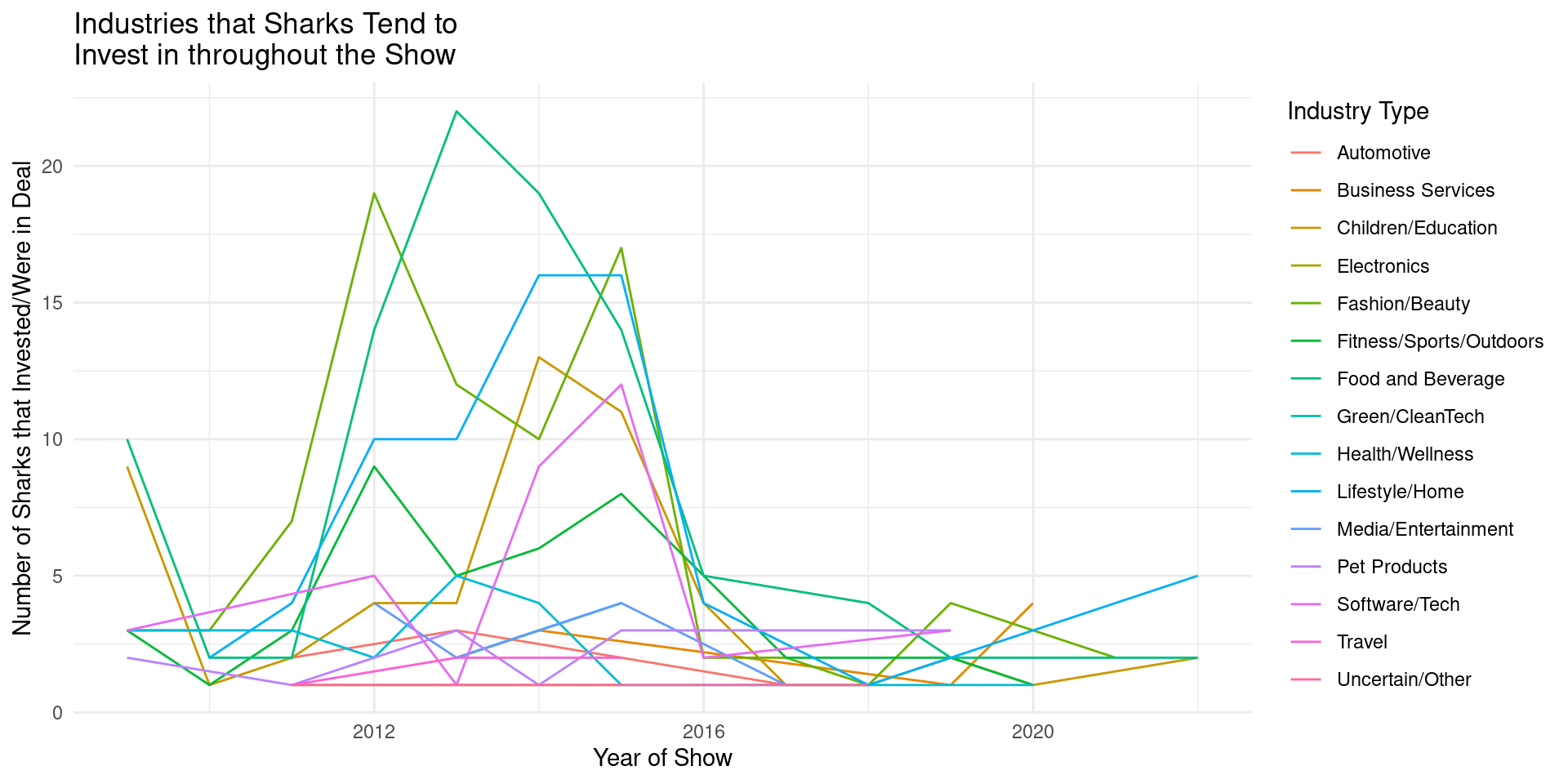

The data contains information about pitchers and their pitches from many different industries. Shown here are plots of the distribution of deals for different industries. In our analysis we’ll look at the characteristics of deals and pitchers and how the Sharks invested in the successful pitches.

Analysis #1: Shark’s deal valuation “deflator”:

Analysis #2: Comparing the pitchers’ gender to getting a deal

# A tibble: 6 × 3

# Groups: pitchers_gender [3]

pitchers_gender got_deal n

<chr> <dbl> <int>

1 Female 0 95

2 Female 1 159

3 Male 0 274

4 Male 1 325

5 Mixed Team 0 67

6 Mixed Team 1 113

Males have a higher chance of getting a deal – 45.74%.

Females have a 37.4% chance

Mixed groups have a very similar percentage at 37.22%.

Yet, many more male pitchers than female; more than double mixed groups

Conclusions + future work

We so far have found that if a company is going to agree to a deal, they should expect their valuations to become between 56.3% to 78.5% of their original valuation depending on the shark.

We also find that some sharks are “greedier” when it comes to valuations than others. We also find that certain industries have had varying levels of success in securing deals with sharks over time.

Lastly, there is a significant difference in the gender success rate, and also the valuations that tend to get a deal are around 15000000, and the ones that do not are interestingly lower.