A Statistical Breakdown of American and European Billionaires

Introduction:

Billionaires dataset from CORGIS

Created by Peterson Institute for International Economics from Forbes data to show how the increase in extreme wealth is increasing rapidly, even though global income growth is slow.

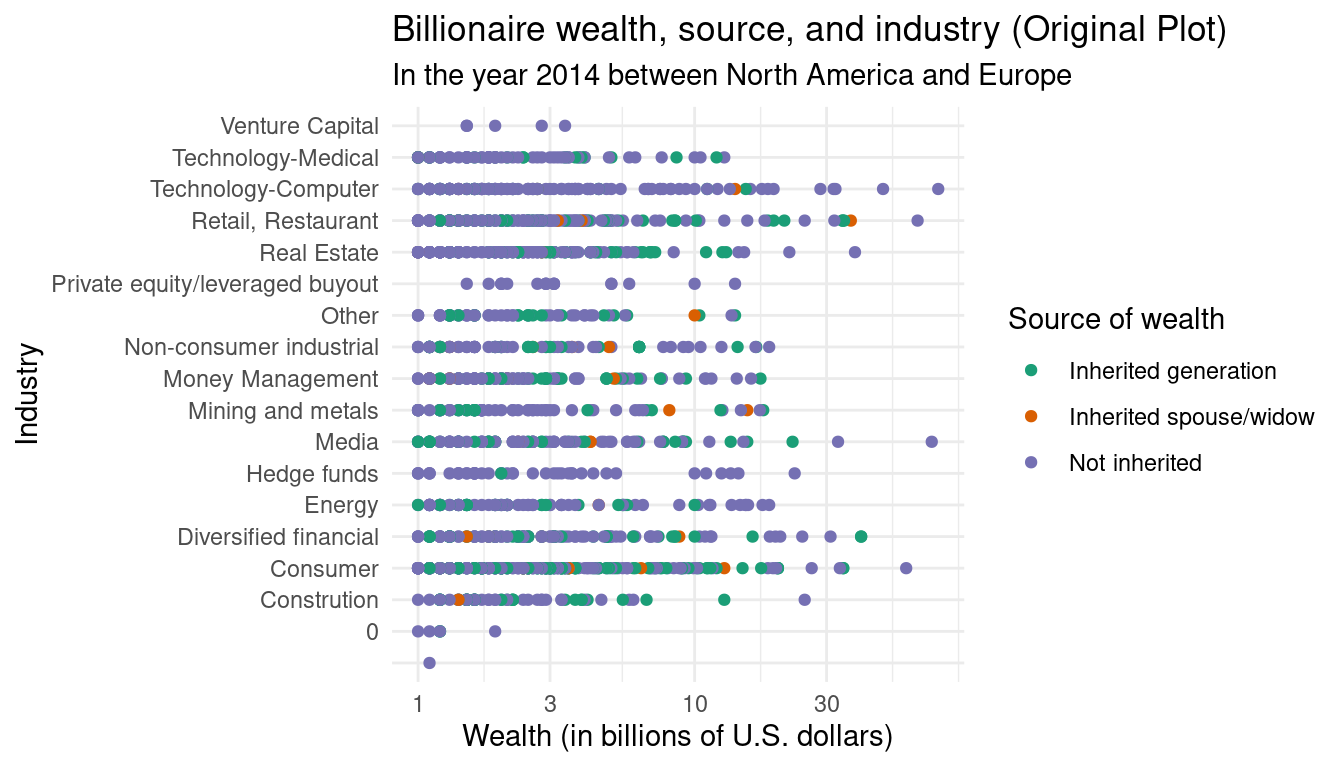

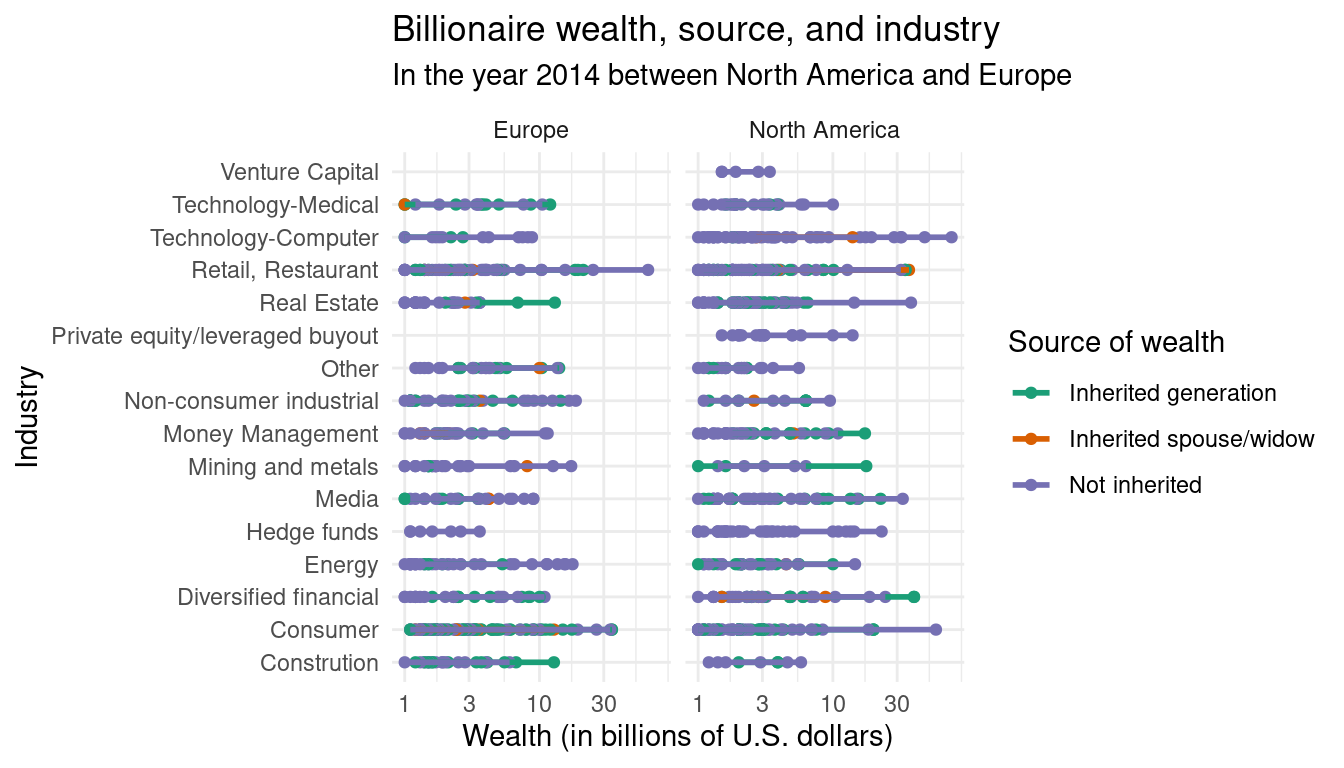

Research question: How do billionaires in the year 2014 between North America and Europe differ in the sources of their wealth, industries they work in, and worth in billions?

Introduce the data

Variables:

rows = billionaires

columns = name of billionaire, rank, company sector, country, region, wealth worth, industry, if the wealth was inherited

Cleanup:

- removed boolean variables, and ones that were not relevant to overall trends (company names)

Highlights from EDA

`geom_smooth()` using formula = 'y ~ x'

# A tibble: 2 × 2

location.region mean_weath

<fct> <dbl>

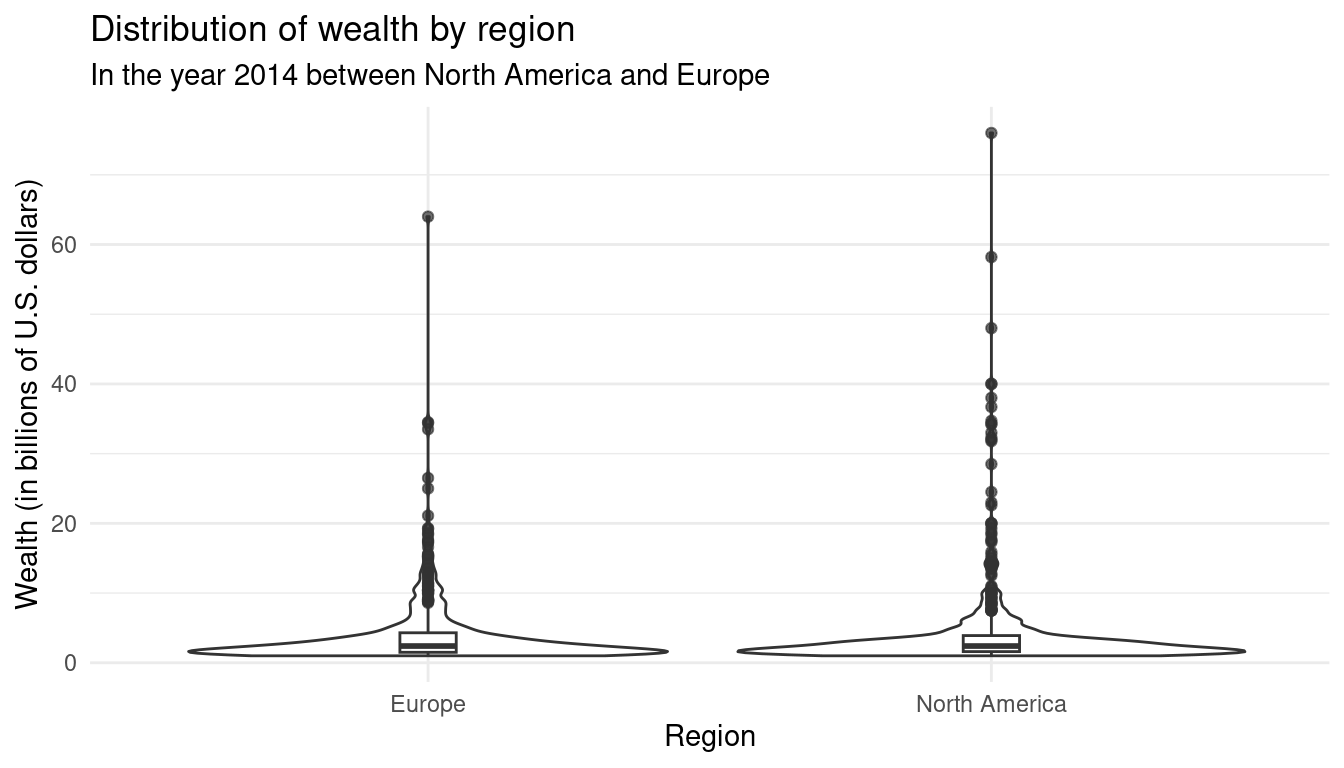

1 Europe 4.16

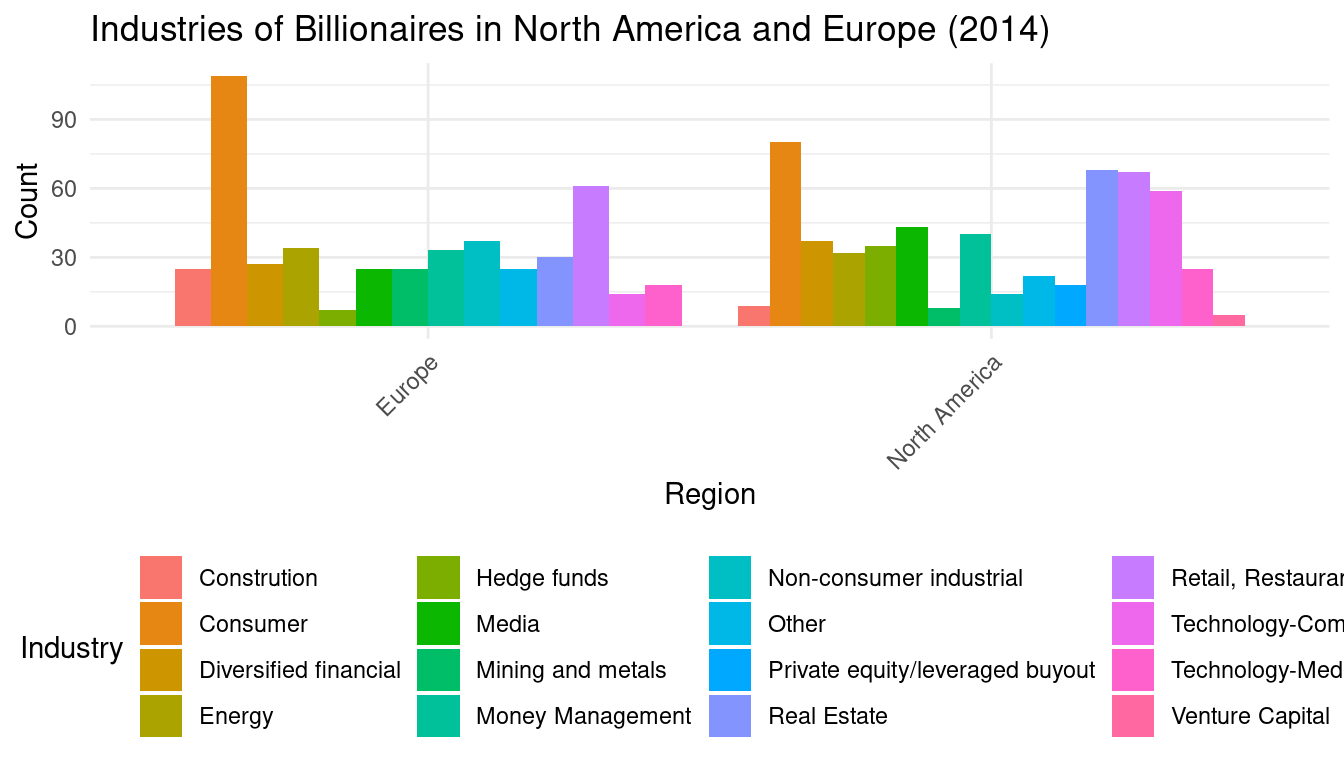

2 North America 4.50Does the industry differ between North America and Europe?

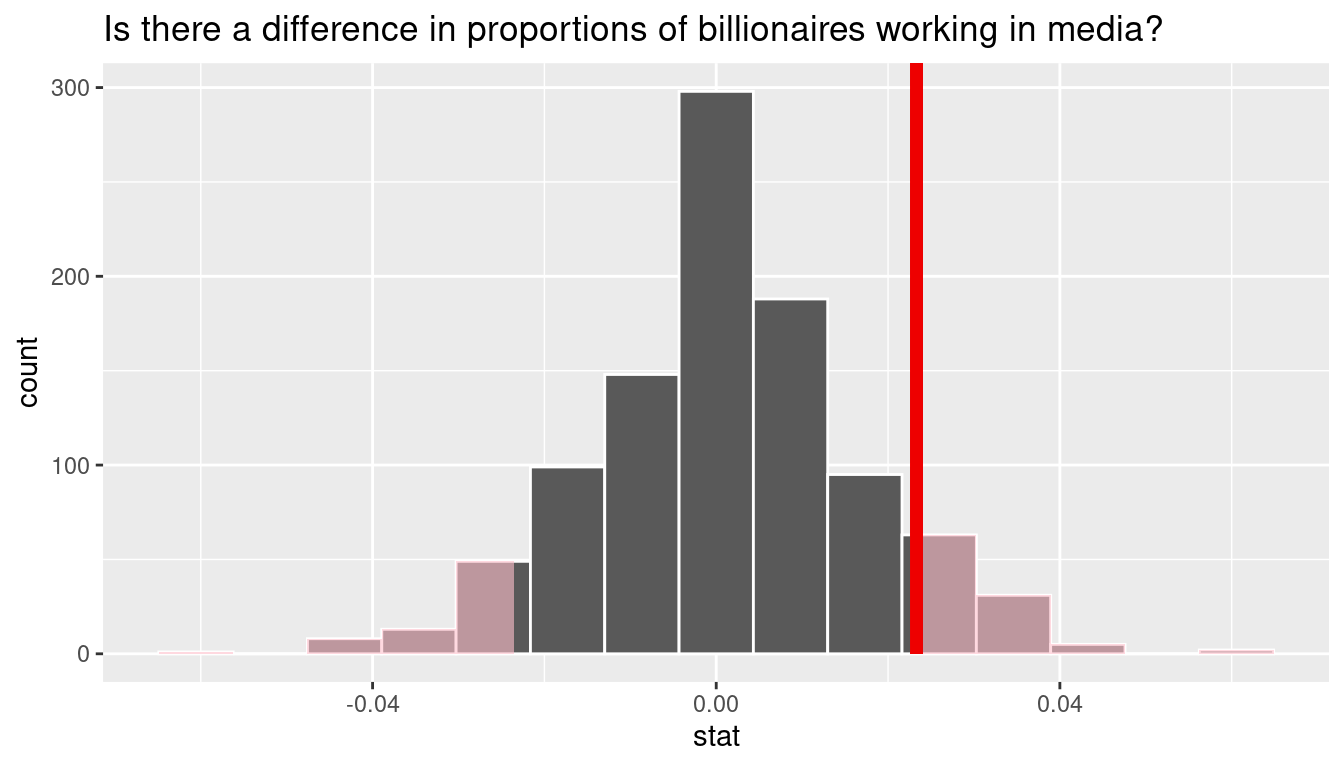

\[ H_0: p_A - p_E = 0 \] \[ H_A: p_A - p_E \neq 0 \]

p-value : 0.202

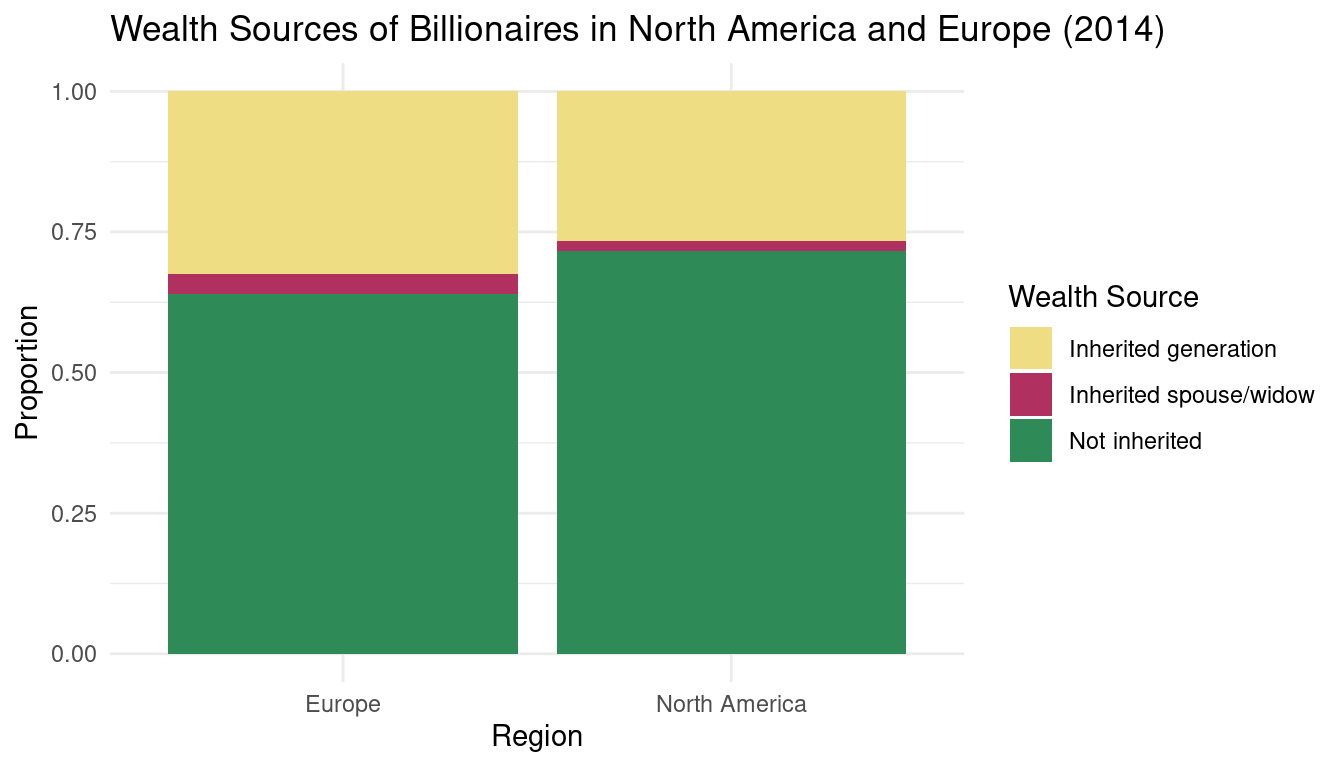

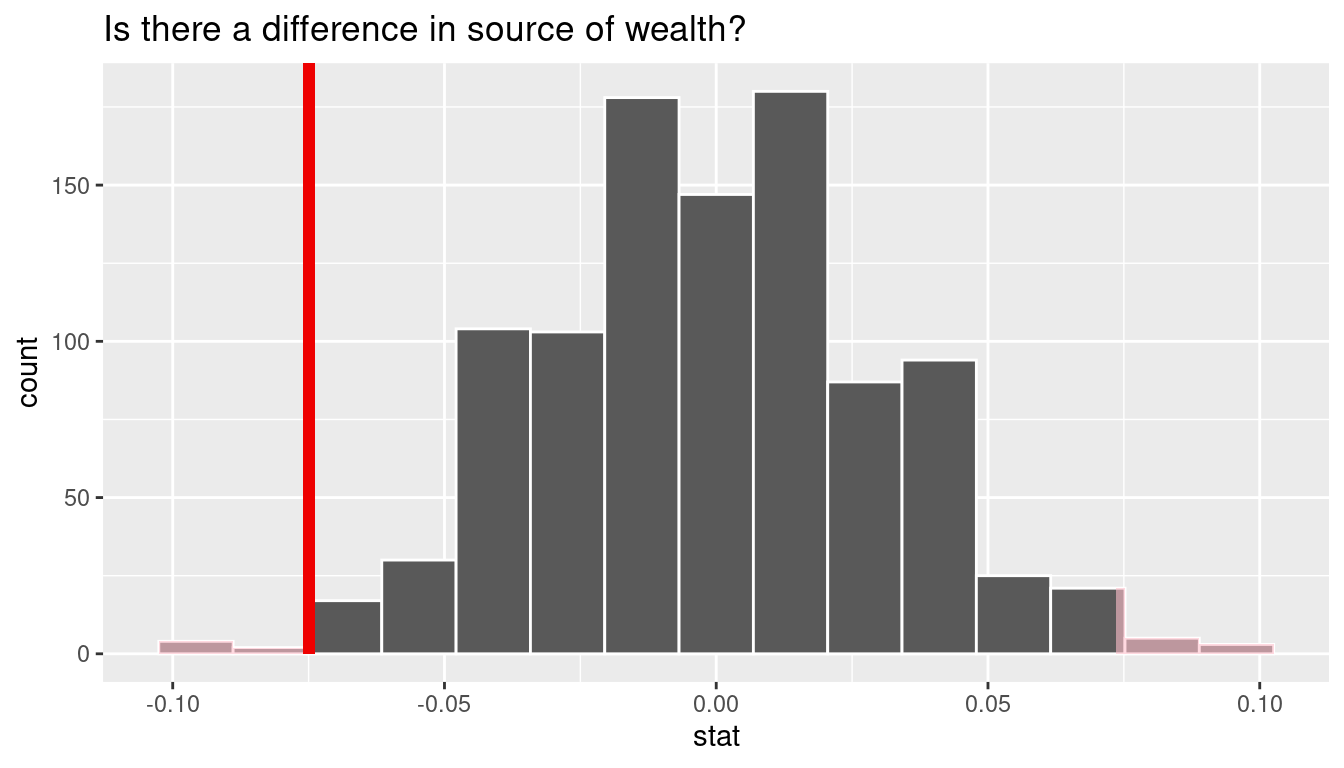

Does source of wealth differ between North America and Europe?

\[H_0: p_A-p_E = 0 \]

\[ H_A:p_A-p_E \neq 0 \]

p-value : 0.018

Conclusions + future work

Compared American and European billionaires

- Industries billionaires work in, specifically media

- Sources of wealth (inherited or not inherited)

Important for understanding wealth inequality

Could compare to developing regions