Deal or No Deal - Investigating Shark Tank Deals Throughout the Show

Team Impressive Pikachu - INFO 2950 Report

Introduction

In this study, we want to explore what makes a Shark Tank pitch more likely to reach a deal on the show and what happens to successful deals. Specifically, we want to observe whether a pitcher’s background influences their likelihood of getting a deal, what happens to a business’s valuation when they reach a deal, as it often involves haggling with the sharks, and how the shark’s investment patterns have varied over time. This information and its conclusions may reveal that certain industries, investors, or investment deals prove to have higher success rates. This, in turn, could serve as a guide to future entrepreneurs looking to pitch their business on the show or simply be interesting for casual viewers of the show who want more insight into their entertainment.

To answer these questions, we will use the Shark Tank US data set created by Satya Thirumani and contributors Arsalan ur Rehman and Jatila Molagoda, along with two other unnamed collaborators. The dataset contains 1,038 observations and 52 attributes related to the pitches made by entrepreneurs to the Sharks in seasons 1 through 14 of the show. The data includes information that was disclosed during the pitch, as well as background information on the entrepreneur and their brand. The purpose of the dataset is to identify any trends among investors, entrepreneurs, and the deals that are made between them. It was distributed on Kaggle and has been downloaded 963 times. It will be updated quarterly and maintained by Satya Thirumani. Each observation contains 52 columns regarding the business pitch. Within these columns, there is a wide range of information. First, there’s details about the pitch as it relates to the Shark Tank show (ie; season, episode, when it aired, etc.). There are columns regarding the company being pitched such as its name and industry, as well as the entrepreneurs who run the company. Finally, there’s a great deal of information for each observation about the economics of each pitch. This includes data about the amount of money requested, the company’s original valuation, and ultimately which sharks (investors), if any, invested in the company and at what new valuation. Due to the nature of the show, where not all companies receive investment, it makes sense that many column/row pairings have blank (ie; NA) values.

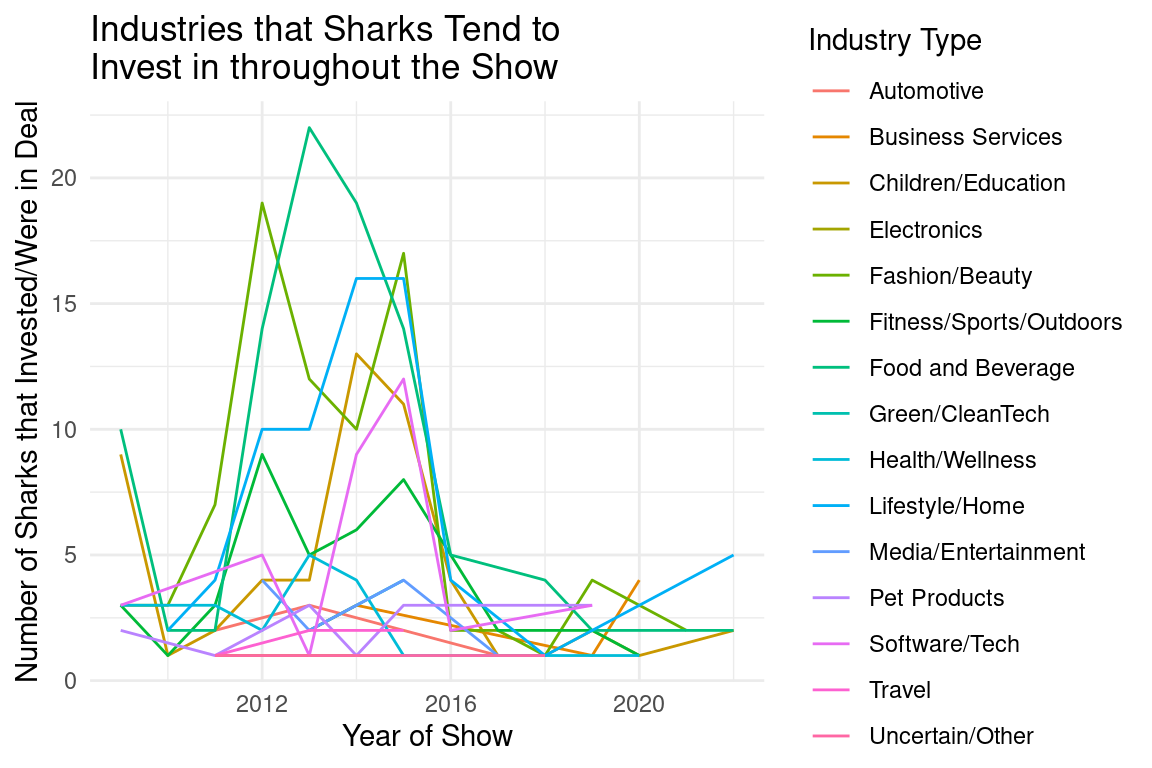

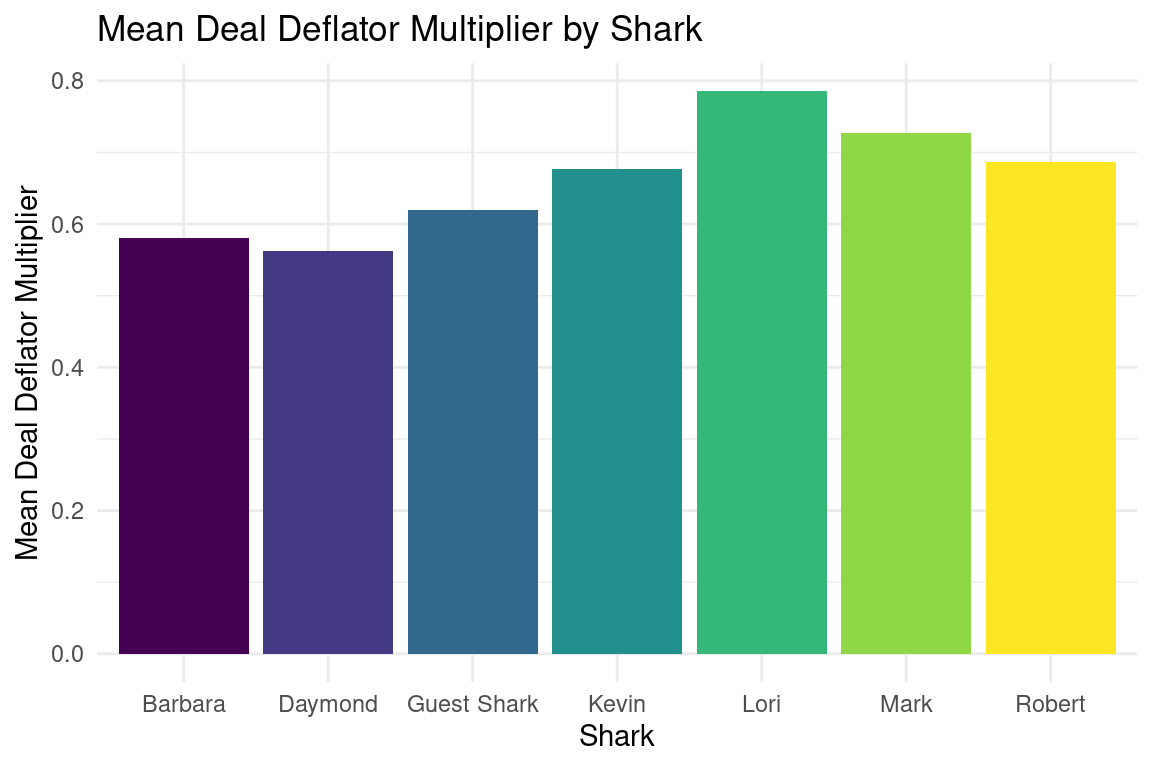

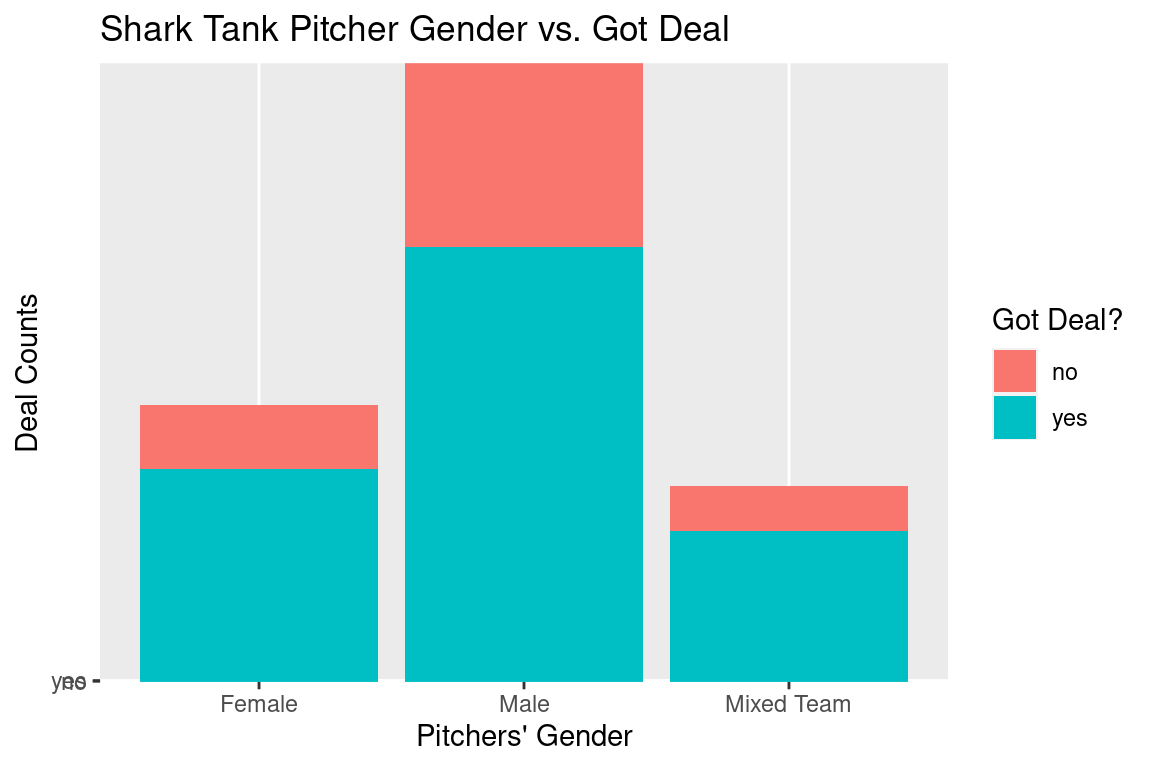

In regards to findings, we find that if a company is going to agree to a deal, they should expect their valuations to become between 56.3% to 78.5% of their original valuation depending on the shark. We also find that some sharks are “greedier” when it comes to valuations than others. We also find that certain industries have had varying levels of success in securing deals with sharks over time. In 2013, the Food/Beverage industry reached the highest number of sharks that invested in a specific industry during one season, being approximately 22 different investments that year. As of the most recent data in 2022, the Lifestyle/Home industry has the most businesses that have secured deals with sharks, with approximately 5 deals. Lastly, we find that there are far more male pitcher groups that reach the show than female and mixed gender groups.

For significant relationships, we find a significant relationship between pitcher’s gender and their success in getting a deal. Male pitcher groups not only are more common, but also reach more deals on a non-random basis. However, we do not find a significant relationship between pitcher industry and deal success. We examined the most common and least common groups, and did not find enough evidence to prove a non-random relationship.

Data analysis

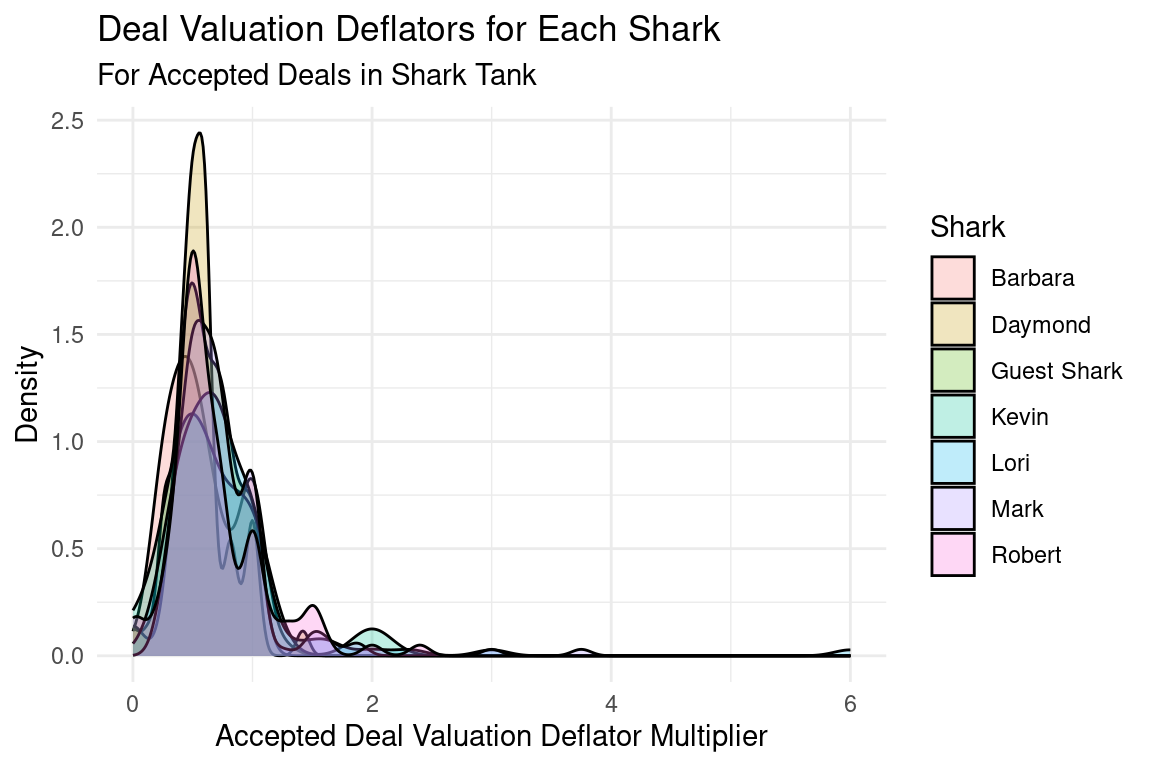

ANALYSIS 1.1 – Data analysis for each shark’s deal valuation and “deflators”:

The “Deal Valuation Deflator Multiplier” is the change in valuation that a company takes when it accepts a deal in the Shark Tank. For example, if a company’s initial valuation is $1 million and their deal ultimately gives them a $500,000 valuation, the multiplier is 0.5 The idea behind this particular analysis is to see how each Shark typically “deflates” the valuations of the companies they invest in.

This information is useful and insightful because it shows that companies should usually expect their valuations to take a certain deflation if they are going to reach a deal in the Shark Tank.

Results:

Valuations of companies where Barbara invests in them are ~58.0% of their original valuation upon entering the tank.

Valuations of companies where Daymond invests in them are ~56.3% of their original valuation upon entering the tank.

Valuations of companies where a guest Shark invests in them are ~62.0% of their original valuation upon entering the tank.

Valuations of companies where Kevin invests in them are ~67.7% of their original valuation upon entering the tank.

Valuations of companies where Lori invests in them are ~78.5% of their original valuation upon entering the tank.

Valuations of companies where Mark invests in them are ~72.7% of their original valuation upon entering the tank.

Valuations of companies where Robert invests in them are ~68.7% of their original valuation upon entering the tank.

We can say, then, that if a company is going to agree to a deal with any of the above sharks, they should expect their valuations to become between 56.3% to 78.5% of their original valuation depending on the shark. We also find that some sharks are “greedier” when it comes to valuations than others. Daymond is the greediest, where he deflates company valuations to ~56.3% of their original asks. Lori, on the other hand, is the least greedy, as her company valuations for deal-companies are 78.5% of their original asks.

It’s clear that in general any company seeking a deal should expect their valuation to take a hit. But, they should also know that if they want a certain shark, their valuation may take even more of a hit than average.

ANALYSIS 1.2 – Data analysis of trends in industries that sharks typically invest in over the course of the show:

The point of this analysis is to see if there are any trends in the kinds of industries that sharks typically make a deal with over the course of the show. This extracted the year from the original_air_date variable of each pitch, and then looked at the number of sharks that invested in each of these deals based on the industry of the business. The number of sharks that invested in a particular industry in a given year were added together to be able to compare which industries experience greater numbers of deals reached based on the year in the show.

This information is ultimately helpful to display trends in industries that are gaining more traction in recent years on the show, which can serve as an asset to business that are looking to pitch their ideas.

Looking at the graph above, there are many interesting results. Starting off the show in 2009, Children/Education and Food and Beverage were the top industries that were invested in that year, with ~10 sharks in deals with those industries. In 2012, there was a huge spike in the Fashion/Beauty industry, with ~17 sharks reaching deals with businesses in that industry. This is interesting given that in 2010, just two years prior, only 3 sharks invested in this industry during the show. The greatest peak achieved by an industry is the Food/Beverage Industry in 2013, with ~22 sharks reaching deals with businesses in this industry. Overall, 2013-2016 are years where certain industries are reaching their peak number of deals that they reach with sharks over the course of the show, experiencing a sharp decline in proceeding years. This is the span of time when sharks were involved in deals with industries in general. In 2016, there was no industry from this point on where a deal was reached with a specific industry over 5 times in one year. Currently, in 2022 (most recent data), the Lifestyle/Home industry is the industry with the greatest number of businesses that have reached deals with the sharks, with this number being ~5. Fitness/Sports/Outdoors and Children/Education are the only other industries that have reached deals with the sharks this year, as no other industry is recorded.

ANALYSIS 2 – Data analysis of the pitchers’ gender in getting a deal:

# A tibble: 6 × 3

# Groups: pitchers_gender [3]

pitchers_gender got_deal n

<chr> <dbl> <int>

1 Female 0 95

2 Female 1 159

3 Male 0 274

4 Male 1 325

5 Mixed Team 0 67

6 Mixed Team 1 113# A tibble: 1 × 3

female_deal_pct male_deal_pct mixed_deal_pct

<dbl> <dbl> <dbl>

1 0.374 0.457 0.372

The above code explores the percentages of different gender pitchers and getting deals. The data shows that males experience a higher chance of getting a deal, at 45.74%. Then, females have a 37.4% chance of getting a deal, and mixed groups have a very similar percentage at 37.22%. It is interesting to note how additionally, the final chart shows how there are many more male pitchers than female and mixed - more than double.

Evaluation of significance

Significance of Analysis 1.1 – Evaluating valuation distributions for pitches that do and do not reach a deal

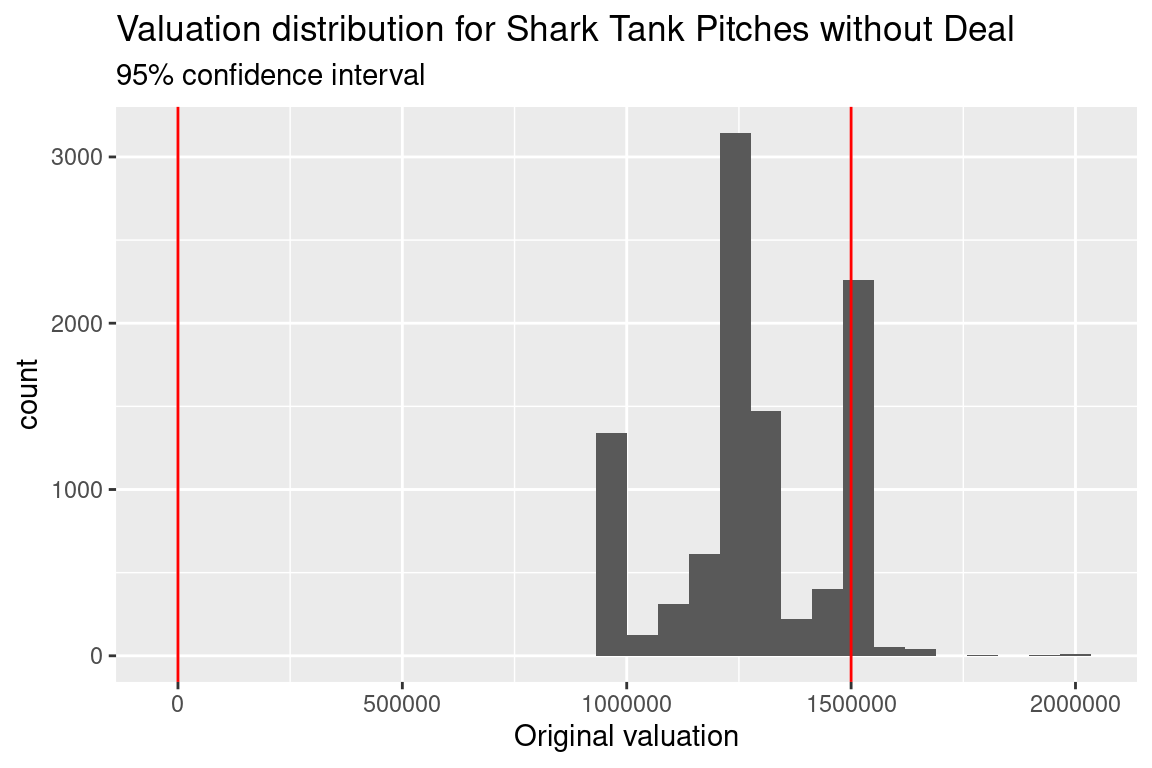

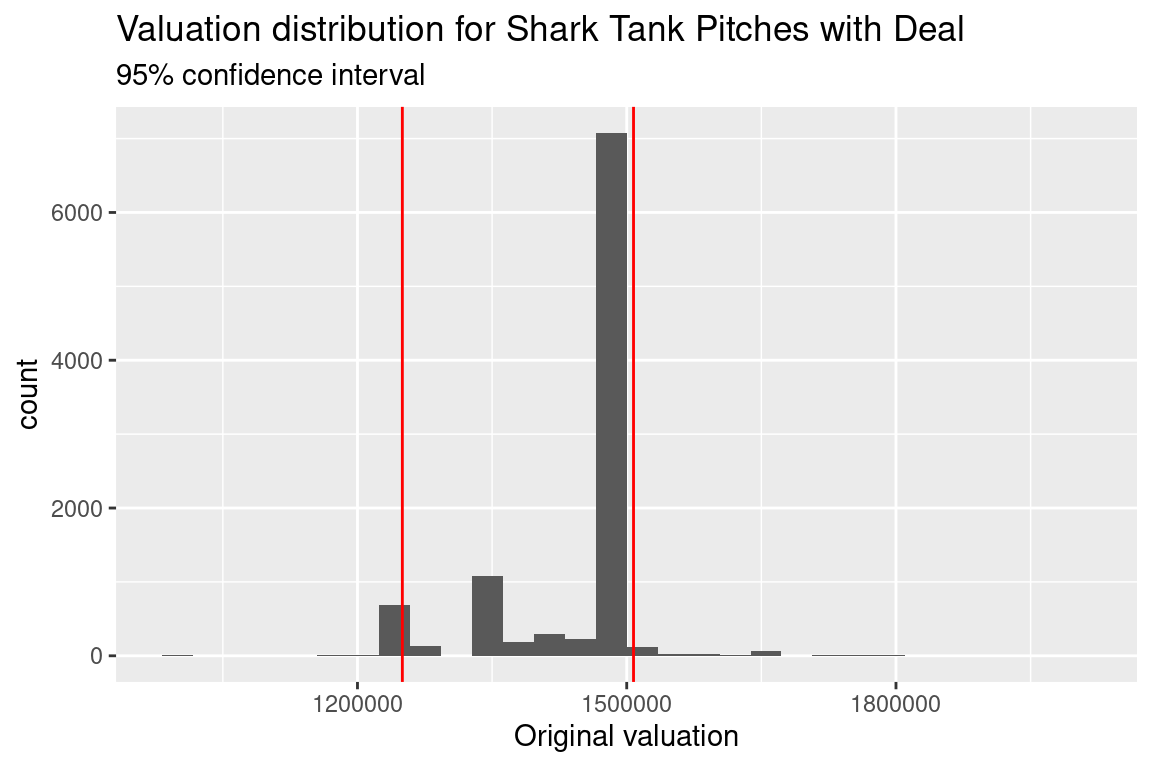

Here, we used statistical work to figure out if there was a significant difference in the medians of the valuations accepted with a deal. After bootstrapping and calculating a 95% confidence interval, one can see that there is a pretty significant difference. For the pitches that did not receive a deal, the confidence interval was (0, 1500000), while the pitches that did receive a deal was (1250000, 1507576). This is interesting and suggests that failing pitches often ask for too low a valuation, or also that bootstrapping was not the correct approach to this data. The distribution of the medians of the deal-pitches is very unimodal, with a peak at just below 1500000, but the distribution of the medians of the non-deal-pitches is more multimodal, with peaks at 9500000, 1250000, and 1500000.

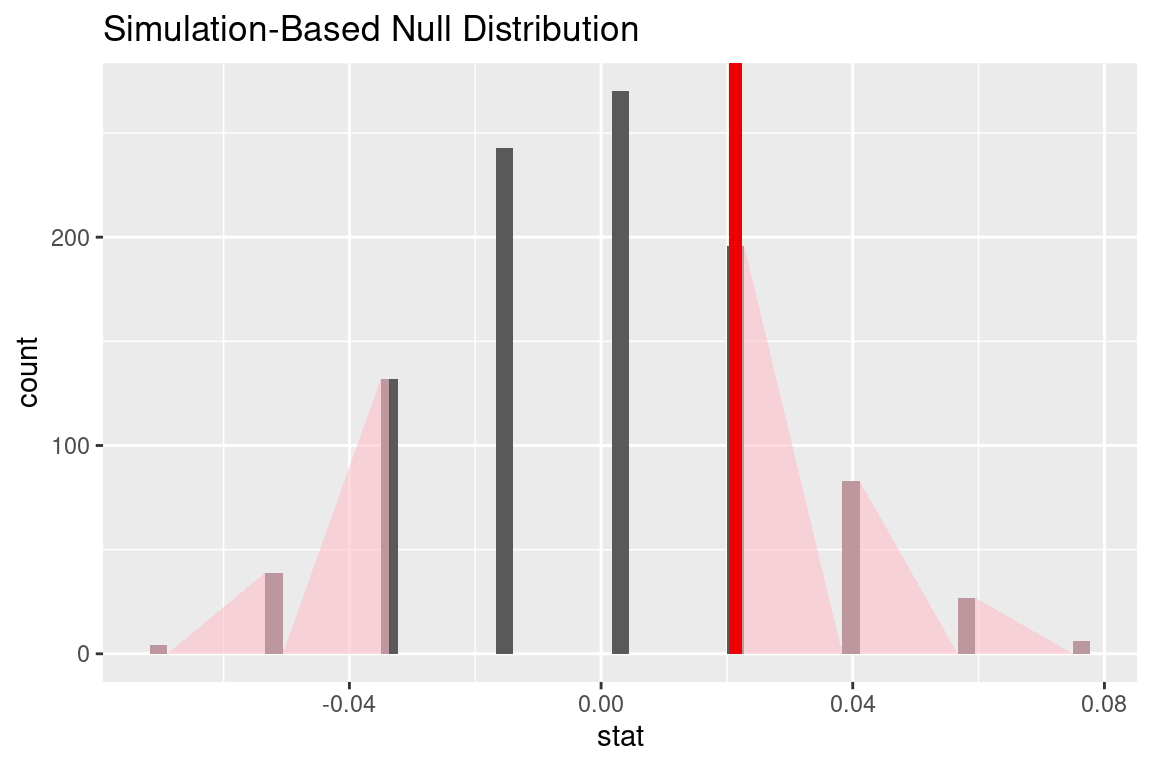

Signficance of Analysis 1.2 – Evaluating relationship between various industries and the number of sharks that invested in them over the show:

We want to see if the relationship between certain industries and them getting a deal throughout the show is random or significant. To do this, we will use a hypothesis test and focus on the Food and Beverage industry vs. the Uncertain/Other industry. We chose to focus on these two industries given that the Food and Beverage industry received the highest number of investors over the course of the show, whereas the Uncertain/Other industry received the least. By comparing these two extremes, we can discern whether these differences in investment numbers are random or significant.

Null hypothesis: The proportion of a Food and Beverage industry pitch and an Uncertain/Other industry pitch in reaching a deal are equal.

\[ H_0 = p_f -p_u = 0 \]

Alternative hypothesis: The proportion of a Food and Beverage industry pitch and an Uncertain/Other industry pitch in reaching a deal are not equal.

\[ H_A = p_f -p_u ≠ 0 \]

# A tibble: 1 × 1

p_value

<dbl>

1 0.624After conducting a simulation test, the p-value is 0.646. This is statistically insignificant, as the p-value is over 0.05. Hence, we fail to reject the null hypothesis. This means that it is completely random (or no effect was observed) in the difference between the proportion of the Food and Beverage industry and the proportion of the Uncertain/Other industry in reaching a deal.

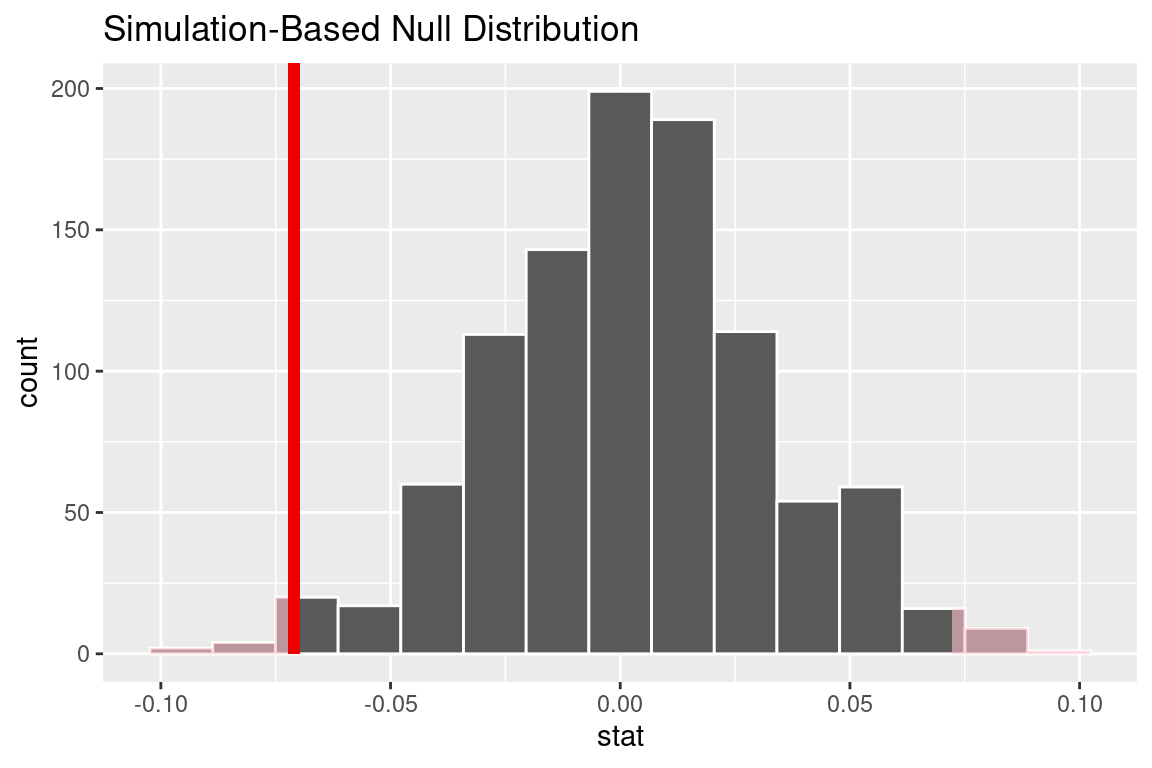

Significance of Analysis 2 – Evaluating relationship between pitchers’ gender and reaching a deal:

We want to see if the relationship between gender and getting a pitch is random or significant. To do this, we will use a hypothesis test and focus on male vs. female pitchers.

Null hypothesis: female and male percentages of getting deals are equal

\[ H_0 = p_m -p_f = 0 \]

Alternative hypothesis: female and male percentages of getting deals are not equal

\[

H_A = p_m -p_f ≠ 0

\]

# A tibble: 1 × 1

p_value

<dbl>

1 0.02After conducting a simulation test, the p-value is 0.02. This is statistically significant (under p = 0.05). Hence, we can reject the null hypothesis in favor of the alternative hypothesis. It is clear that males experience different odds of success in getting a deal than females, perhaps hinting at an underlying bias in the sharks’ tendencies.

Interpretation and conclusions

In conclusion, there are significant trends in the patterns of shark tank deals. Recapitulating our research question, the point of this study was to explore what makes a Shark Tank pitch more likely to reach a deal on the show and what happens to successful deals. Specifically, we wanted to observe whether a pitcher’s background influences their likelihood of getting a deal, what happens to a business’s valuation when they reach a deal, as it often involves haggling with the sharks, and how the shark’s investment patterns have varied over time.

After completing the analyses, we have found that if a company is going to agree to a deal, they should expect their valuations to become between 56.3% to 78.5% of their original valuation depending on the shark. We also find that some sharks are “greedier” when it comes to valuations than others. Specifically, Daymond tends to cut the original valuations by the most, and Lori by the least: 56.3% and 78.5% of the original valuation, respectively. Also, in regards to original valuations and getting a deal, through bootstrapping we have found that actually, the pitches that reach a successful deal tend to have a higher median pitch. Our confidence intervals showed that failed pitches sometimes are too low, which perhaps shows that sharks are often more eager to invest in pitches that are more confident in themselves.

In regards to industries, we find that certain industries have had varying levels of success in securing deals with sharks over time. The Children/Education and Food and Beverage industries were the most invested in during the show’s early years in 2009, with about 10 sharks reaching deals with companies in those industries. The Food/Beverage industry reached its peak in 2013, with approximately 22 sharks investing in that industry. In 2016, sharks were more hesitant to invest, and no industry has had more than 5 deals in a given year since then. As of the most recent data in 2022, the Lifestyle/Home industry has the most businesses that have secured deals with sharks, with approximately 5 deals. However, a significant relationship between industry and deal success rate does not appear. This shows us that in creating a shark tank pitch, a pitcher should not be afraid to choose whatever category they want: other factors are more important.

Lastly, our analysis of gender shows us that male pitchers experience better odds at getting a deal than female pitchers. Further, the demographics of the pitchers are majority male, then female, and lastly mixed.

We hope that this paper could serve as useful information for potential pitchers on Shark Tank. Despite the limited scope of our project, it is clear that there are underlying biases and trends in the patterns of sharks.

Limitations

Our limitations arise from the fact that we examine one variable at a time. This increases the probability of confounding factors, and hence to prove the patterns we must use significance tests. We also face toolkit limitations: with the significance tests, we are limited to examining binary categorical variables - with looking at the significant relationships between industry and got_deal, most notably, we were limited to focusing on two industries at a time. Hence, we had to select two industries; we chose the most common and least common, but a more in depth analysis would look at all industries and perhaps reveal a different significance.

Next, the show has many ineffable qualities that the data set does not include. The data set only looks at the exterior characteristics of the final deal, and not what went on to lead to this conclusion. This includes ideas like the contestant’s qualifications, pitching skill, and other similar qualities. The variables that truly decide the deal for the shark likely are not included in our limited set. However, our analysis still points out patterns that are hard to dispute.

Acknowledgments

Our work was completed by our own group with the help of our TA and peer comments from our section. Additionally, we wanted to give a shout out to Kaggle for providing us with a great data set for analysis for free.